Created by the Financial Planning Association of Australia, Match My Planner is an online service to help connect Australians looking for a financial planner with FPA CFP professional® members. It’s designed to create matches based on their personal profile of money and life goals, not just location. It instantly notifies eligible FPA members that consumers are interested in financial planning services and it facilitates open conversation between consumers and FPA members in order to build trusted relationships with potential clients via the messaging feature on the member app.

Looking for a financial planner?

FPA members represent the highest professional and ethical standards in financial planning. Use our Match My Planner service to find one near you.

frequently asked QUESTIONS for cfp® professionals

How do I download Match My Planner?

If you are a CFP® professional, you can access Match My Planner. Download the app onto your smartphone from the App store or the Google Play store.

How do I login to Match My Planner?

Login to Match My Planner using your FPA Member Centre credentials. If you have changed your username at any point, you will need to use this instead of your member ID.

How does the matching process work?

Here’s how:

1. Location: Match My Planner uses location as the first way of filtering.

Location matching is fairly broad for now to make sure every consumer request gets seen and is contacted by a CFP professional. So currently, this means you have been receiving client requests from people located within 50km from you.

2.Now we put the ‘matching’ in your hands. You receive an app notification that gives you a snapshot of the potential client and their situation. We want YOU to self-match if you think you’re the right planner for the client. Is this client similar to others that you see and have experience around, are you in a position to see new clients at the moment? These are things that you can quickly and easily decide after scanning the lead.

This is called an on-demand matching marketplace i.e. the consumer indicates they need a service and the service provider (i.e. you) reviews the lead and decides if you’re best placed to help them and then you reach out as the ‘match’.

3. There’s a limit to the number of planners who can respond. When a person uses Match My Planner, we ask them to tell us if they want to hear from just three, five or up to ten planners. We encourage people to chat to a few different planners to find one they feel is most suited to them.

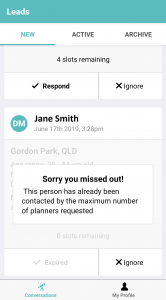

When a new client lead comes in, it’s first-in first-served – so leads are getting responded to very quickly by CFP professionals. So you might see a lead but it says ‘sorry you missed out! This person has already been contacted by the maximum number of planners requested’. This means the quota of planners responding has already been filled. As we start to ramp up our promotions, they’ll be more leads coming and more opportunities for everyone to respond to. But at the moment it’s very competitive.

4. Then it’s up to the consumer! The last important part is that when you’re responding to the consumer, it’s basically a pitch for the business. We give the consumer full control to decide what they want to do next. They can decide to write back and start a conversation with you and hopefully this leads to an appointment booked directly with you. But they can also ignore or reject your message. It’s important that we give the consumer the full control. It’s about building trust.

Why not filter by area of financial planning specialisation?

To answer this, we need to give some quick background to Match My Planner – the evolution of the original FPA Find a Planner.

We conducted consumer research before embarking on the redesign to understand how we could help people to find a financial planner in a more intuitive and meaningful way.

The consumer research told us:

1. A local planner is good. For most people, a conveniently located financial planner is important.

2. But what they’re really looking for is someone they can trust. The common criteria when seeking a planner is:

- Trust

- Comfort

- Rapport

- Impartiality

- Tailored recommendations

- Reputation

Finding a solution to help people identify this is the key to the new Match My Planner.

3. What about filtering by specialisation? People know they need help with their financial situation but they don’t really understand the jargon. The research uncovered that most people struggle to differentiate or understand the specific types of advice e.g. risk management, aged care, estate planning, wealth accumulation etc. So asking them to select from a list of financial planning specialty areas isn’t the best way to help them. A second reason filtering by specialty areas isn’t helpful is that the majority of financial planners do in fact offer a wide spectrum of advice solutions. So we’re not really offering a solution of narrowing down the number of planners to present to help people decide.

With this knowledge, we built Match My Planner.

For everyone, having a tool that helps them easily communicate with you directly helps them build rapport with you, feel comfortable and know if you’re the right for kit for them.

Location is still useful.

And particularly for those in densely populated metro areas where there’s hundreds of planners to choose from, they want help removing the confusion and overwhelm in deciding who to contact.

Why am I not able to message client requests? They are greyed out and the only option is to 'ignore’.

As mentioned above, we allow people to tell us how many financial planners they want to hear from. So there’s a limit to the number of planners who can respond per client. When a person uses Match My Planner, we ask them to tell us if they want to hear from just three planners, five planners or up to ten planners. We encourage people to chat to a few different planners to find one they feel is most suited to them.

When a new client lead comes in, it’s first-in first-served – so leads are getting responded to very quickly by CFP professionals. So you might see a lead but it says ‘sorry you missed out’, similar to the below image.

This means the quota of planners responding has already been filled. When you see this message, you may simply tap ‘ignore’ and it will disappear. As we start to ramp up our promotions, they’ll be more leads coming and more opportunities for everyone to respond to. But at the moment it’s very competitive.

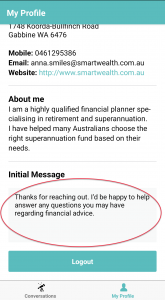

To help you respond quickly, make use of the ‘Initial Message’ box on the ‘My Profile’ section of the app. When you respond to a client request, the text from your initial message box will appear. You can amend this text to personalise your message.

So when I get an app notification, do I have to respond?

No you don’t, it’s your choice. The app notification is just a signal that there’s a person looking for a planner. If you’re busy, if you’re not in a position to see new clients, you can simply ignore the app notification and go about your day.

But if you’re in a position to chat to potential clients, as soon as you get the app notification, jump into Match My Planner, review the client profile. You can then decide if this potential client is right for you based on their location, financial needs or demographics.

Why am I receiving leads from people whose financial needs don’t match my service?

It is difficult for clients to understand specialisation within financial planning. Rather than put the burden on them, we want to you have a quick scan of the client profile and make a quick decision on whether this matches your services or not. If you’re not interested, simply ignore it. If you’re interested, then respond to the client.

I'm getting a 'Something's gone wrong' message. How do I fix this?

As Match My Planner is still in its soft launch phase, we are continuing to push through new updates to improve its features and functionality. Sometimes, your app may not have pushed through the latest update. To refresh your app, please log out and login again.

I'm having issues logging into Match My Planner. How do I fix this?

There are a number of reasons why you may not be able to login to Match My Planner:

- You are using your Member ID when you should be using your Username. For a majority of FPA members this is your 6-digit Member ID. However, if you actively changed your username to something else (e.g. ASMITH), this will be the username you need to use to login to Match My Planner.

- You are not a CFP professional. Currently, Match My Planner is only accessible to CFP professionals. We will be launching the tool to all practitioner members later this year.

- You haven’t paid your membership fees. Match My Planner is only accessible to active CFP professionals currently. If you haven’t paid your membership fees, please contact Member Services on 1300 337 301 to arrange payment.

- You have incorrectly entered your password too many times and are now locked out. If you are locked out, please contact Member Services on 1300 337 301 to have your account unlocked.

If the above does not apply to you and you are still unable to login to Match My Planner, please contact Member Services on 1300 337 301.

How do I change my profile details?

To change your Match My Planner profile details, you simply login to your Member Centre and change your Find a Planner profile details. Here’s a quick guide to help you.

If your question hasn’t been answered, please contact us using the form below, or directly via our Contact Page.